As an employer you are the Fiduciary to your retirement plan. The definition of a Fiduciary is someone who is managing the assets of another person (your employees) and stands in a special relationship of trust, confidence and/or legal responsibility. This is not much different than the legal responsibility you have to your customers when selling your product and/or service. So how do you reduce your exposure in a retirement plan? You prove that all of your investment decisions are prudent and in the best interest of your employees by putting processes in place which document how and why your decisions are being made. IME Financial, LLC* has created the Fiduciary Protection System to help you do just that.

As an employer you are the Fiduciary to your retirement plan. The definition of a Fiduciary is someone who is managing the assets of another person (your employees) and stands in a special relationship of trust, confidence and/or legal responsibility. This is not much different than the legal responsibility you have to your customers when selling your product and/or service. So how do you reduce your exposure in a retirement plan? You prove that all of your investment decisions are prudent and in the best interest of your employees by putting processes in place which document how and why your decisions are being made. IME Financial, LLC* has created the Fiduciary Protection System to help you do just that.

Fiduciary Protection System

When setting up a system that isn’t in your area of expertise it is critical to partner with an expert in that field. At IME we are retirement plan experts. Over the last 26 years we have built our expertise in retirement plan administration, process effectiveness, and compliance. These skills coupled with the Accredited Investment Fiduciary Analyst (AIFA®) designation, the Global Financial Steward (GFS®) designation and the Certified Plan Fiduciary Analyst (CPFA) designation fulfill a need seen in the financial industry. That need is risk reduction through a prudent and sound fiduciary process of governance. As an AIFA, GFS and CPFA, we help you implement and maintain processes and procedures for fiduciary oversight while also taking on a Co-Fiduciary relationship with you and your plan.

When setting up a system that isn’t in your area of expertise it is critical to partner with an expert in that field. At IME we are retirement plan experts. Over the last 26 years we have built our expertise in retirement plan administration, process effectiveness, and compliance. These skills coupled with the Accredited Investment Fiduciary Analyst (AIFA®) designation, the Global Financial Steward (GFS®) designation and the Certified Plan Fiduciary Analyst (CPFA) designation fulfill a need seen in the financial industry. That need is risk reduction through a prudent and sound fiduciary process of governance. As an AIFA, GFS and CPFA, we help you implement and maintain processes and procedures for fiduciary oversight while also taking on a Co-Fiduciary relationship with you and your plan.

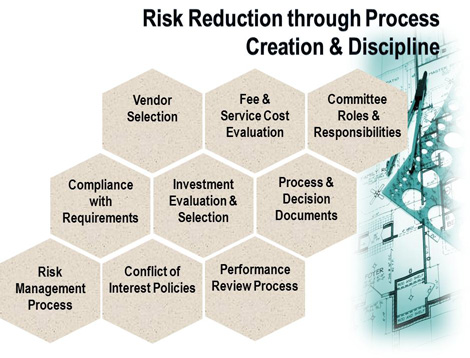

As a Co-Fiduciary we sit next to you at the table of responsibility. We are your Fiduciary “architect” guiding you in the construction of your fiduciary investment processes some of which are shown to the right. This is how IME helps you reduce your risk – creating processes and instilling process discipline. In a sense, once you have your processes up and running, IME becomes like a quality manager. We help you evaluate your processes, make recommendations and provide documentation that will reduce your risk with the IRS and DOL.

Click Here to Discover More About Your Fiduciary Risk

Snapshot of Fiduciary Consulting Services

An AIFA® has received their designation through the Center of Fiduciary Excellence providing oversight guidance for the employer (who is the primary Fiduciary). A GFS® has received their designation through the Leadership Center for Investment Stewards which inspires and trains leaders to serve more effectively as stewards in critical decision-making roles. A CPFA has received their designation through the National Association of Plan Advisors which demonstrates the individual’s knowledge, expertise and commitment to working with retirement plans and helping plan fiduciaries manage their roles and responsibilities. The AIFA® designation means that we are up-to-date with fiduciary best practices encompassing the four cornerstones of a prudent fiduciary process which are: Diversification of investments, Operating as a prudent expert, Reasonableness of plan expenses and Operating for the exclusive benefit of plan participants. The GFS® designation means we have been trained in LeaderMetrics which is a framework applied to fully integrate leadership and a decision-making process to substantiate multiple standards of care – fiduciary, governance, and project management standards. And the CPFA designation means we have the expertise required to act as a plan fiduciary. Services include:

| Service | Details |

|---|---|

| Core Solutions |

|

| Optional Services |

|

* A wholly owned subsidiary of Dynamic Pension Services, Inc.